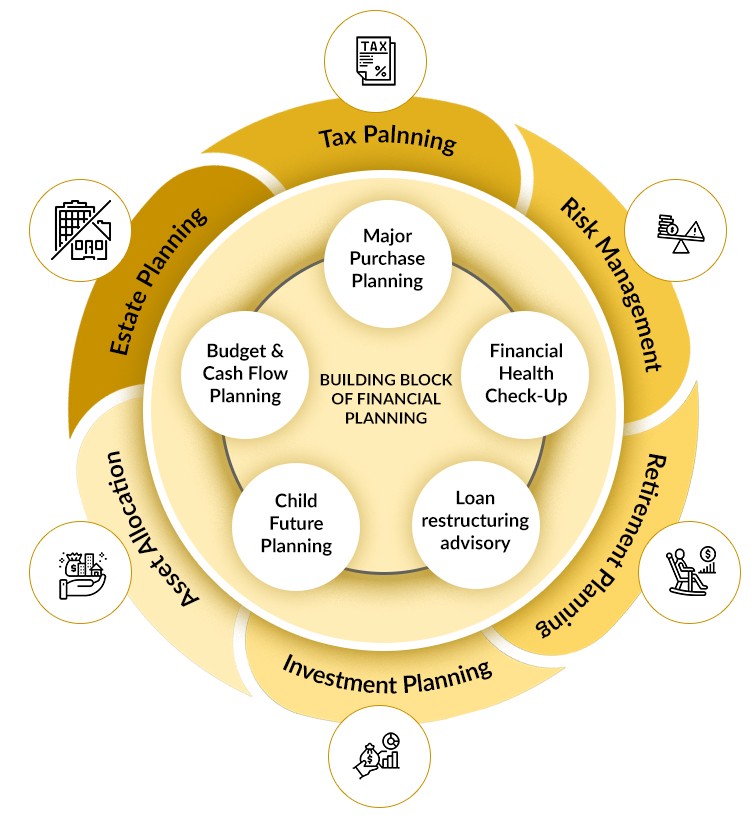

To provide an organized and disciplined service delivery process in terms of Investment and Wealth Management, we have categorized our service structure under two basic categories: -

Financial planning may mean different things to different people. For one person, it may mean planning investments to provide security during retirement. For another, it may mean planning savings and investments to provide money for a dependent's college education. Financial planning may even mean choosing the right insurance products or just targeting capital appreciation on investable surplus.

The key to Personal Financial Success lies in how efficiently, Financial Planning is done by an Individual. It requires in depth study and understanding of various financial aspects of an individual like Risk Taking Ability, Liquidity Requirements, Financial Goals, Inflation, Current Cash Flow and Expenses, Clients Investment Approach etc.

We at Paragonaide Financial Services create a 360° view of a client’s financial position through a detailed financial profiling process. Based on the same we can guide our clients towards achieving their long-term Financial Goals and ensure a progressive and purposeful approach.

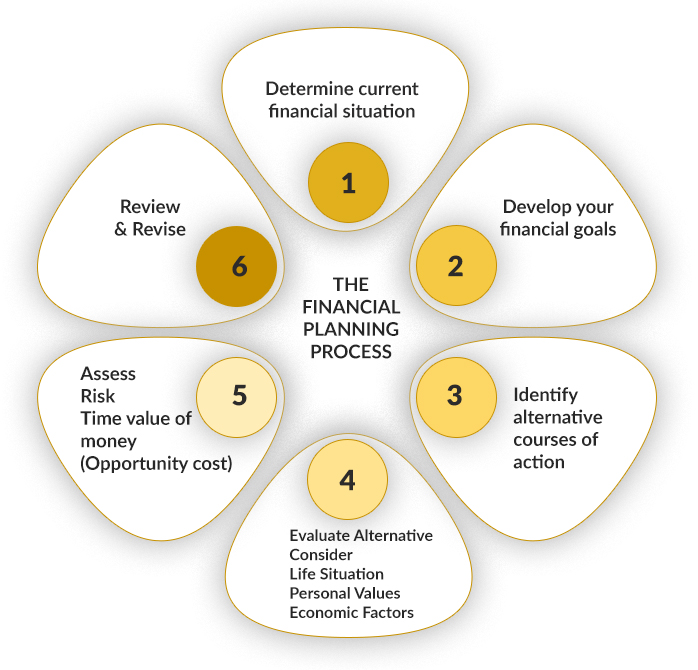

A brief representation is given here on how we follow and guide our Clients on the Financial Planning Process.

In today’s uncertain world insuring one’s Risk is an important aspect. Through our detailed Financial Profiling Process, we can assess clients Risk and guide them to have adequate Risk Cover based on their current financial liabilities and responsibilities. With the widest range of products available with us through the best of the companies we provide a variety of General and Life Insurance Products to our clients.

Know more about the range of Insurance products offered by us.

Estate planning is the preparation of tasks that serve to manage an individual's asset base in the event of their incapacitation or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes. We have a group of experienced attorneys in estate law who help set up estate plans for our clients.

Assets that could make up an individual’s estate include houses, cars, stocks, artwork, life insurance, pensions, and debt. Individuals have various reasons for planning an estate, such as preserving family wealth, providing for a surviving spouse and children, funding children's or grandchildren’s education, or leaving their legacy behind to a charitable cause.

QROPS or Qualifying Recognised Overseas Pension Scheme, is an overseas pension scheme that meets certain requirements set by Her Majesty's Revenue and Customs (HMRC). A QROPS can receive transfers of United Kingdom (UK) Pension Benefits without incurring an unauthorised payment and scheme sanction charge.

Indians who have worked in UK might have made some regular contribution from their income towards a pension fund. Now if they plan to move out of UK, the UK Government allows transfer of their pension funds to pension schemes in India registered as QROPS.

QROPS is an overseas pension scheme that can receive transfers of UK Pension Benefits without incurring an unauthorised payment and scheme sanction charge.

QROPS is popular with UK’s expatriates and Indian nationals who have worked in the UK because it can facilitate transfer of money from UK to India.

You get the potential for better returns by investing your money in Indian markets. You can get your lifelong pension and on death, fund value will be paid to your nominee.

In endeavour to provide one stop solution we at Paragonaide Financial Services provide a range of Loan and Advances services to our clients. Clients require loan or funding for fulfilling their short-term cash flow requirements. It could be a loan to buy a house, to expand their business etc.

Following are the list of services offered by us under Loan and Advances -

Real Estate forms a part of our Investment and Wealth Management service. Real Estate is one of the best long-term Investment Assets. These days Individuals and Corporate are very keen on investing into Real Estate. While Individuals would like to invest into a House, Flat, Commercial property, Farm house, Holiday home etc for different reasons ranging from Capital Appreciation to Rental Income or building a retirement home. At the same time Corporate Bodies like to invest in Commercial Land, Running Industrial Property (like Plant or Storage Facility) or Commercial Property with the aim of facilitating their running business or investing their investible surplus.

We Provide Following Services under Real Estate -

Know more about the range of options available under REAL ESTATE

Copyright 2024 FINTSO. All Rights Reserved